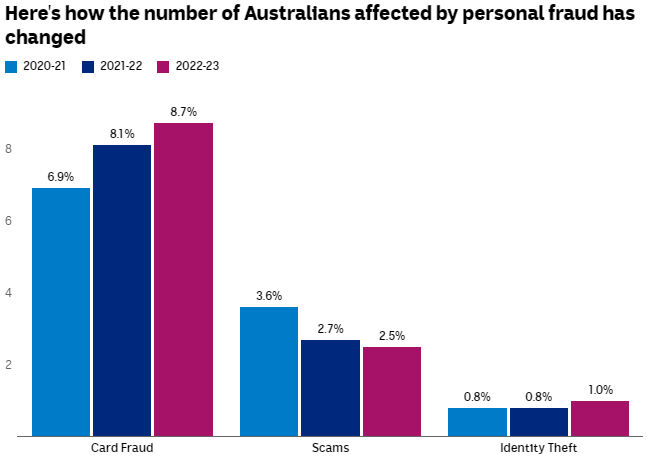

New data released by the Australian Bureau of Statistics (ABS) reveals that Australians lost an estimated $2.2 billion to card fraud in the last year. The report, published on Wednesday, highlights a significant increase in fraudulent activities, with 1.8 million people (8.7 per cent) experiencing card fraud in 2022-23, up from 8.1 per cent the previous year.

In addition to card fraud, the ABS report indicates that 514,300 individuals (2.5 per cent) fell victim to various scams, and just under 200,000 people (1.0 per cent) experienced identity theft.

These findings underscore the growing need for enhanced security measures and increased public awareness to combat financial fraud and protect personal information.

Source: Australian Bureau of Statistics

According to the latest report from the Australian Bureau of Statistics (ABS), card fraud involves the unauthorized use of credit, debit, or EFTPOS card details to make purchases or withdraw cash without the account owner’s permission. The number of Australians affected by card fraud has seen a notable increase, rising from 6.9 per cent in 2020-21 to 8.7 per cent in 2022-23.

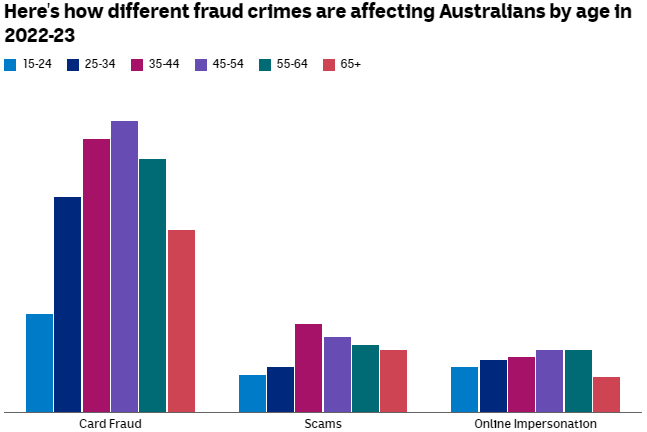

The report also highlights that individuals aged 45-54 are the most frequently affected by card fraud. This demographic trend underscores the need for targeted awareness and protective measures to safeguard this age group against financial fraud.

These findings emphasize the importance of enhanced security measures and increased public awareness to combat the growing threat of card fraud and protect personal financial information.

Source: Australian Bureau of Statistics

William Milne, the head of crime and justice statistics at the Australian Bureau of Statistics (ABS), has noted a “sizeable increase” in the number of Australians falling victim to card fraud.

Milne pointed out that certain demographics are more at risk. “It tends to be older people, specifically those aged 35-64, individuals in married relationships, and those in higher income brackets,” he said.

He explained that this trend is logical, as these groups typically have greater access to financial instruments such as credit and debit cards. “When you think about it, that makes perfect sense, because they’re the ones who have more access to credit cards, debit cards, those sorts of financial instruments,” Milne added.

Milne also suggested that the number of cards an individual holds could increase their likelihood of experiencing card fraud. “Personally, I think it’s going to be the number of cards you’re holding that increases your likelihood of card fraud,” he concluded.

These insights underscore the importance of targeted awareness and protective measures for those most at risk of card fraud.

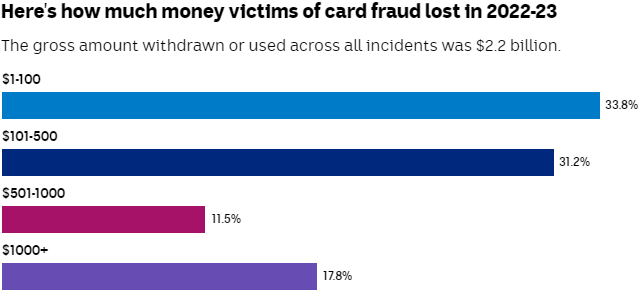

A small number did not know how much money was withdrawn/used.

Source: Australian Bureau of Statistics

The Australian Bureau of Statistics (ABS) has provided a comprehensive analysis of card fraud in Australia, revealing that married individuals are almost three per cent more likely to be affected by card fraud compared to their unmarried counterparts. Additionally, the report highlights that people living in capital cities, those with tertiary or post-school qualifications (including certificates, diplomas, or degrees), and individuals in the highest bracket of weekly household incomes are more frequently targeted.

William Milne, head of crime and justice statistics at the ABS, noted that the median amount fraudulently withdrawn or spent per card fraud incident was approximately $200. The total gross amount withdrawn due to card fraud was $2.2 billion, averaging about $6 million per day. After reimbursements, the net loss for all victims stood at $476 million.

In a related development, the Australian Competition and Consumer Commission (ACCC) released its own report for 2023, indicating that over $82 million of the total amount was lost in the last three months of the year. An ACCC spokesperson clarified that while the ABS data represents a sample of the Australian population, Scamwatch data is based on reports from individuals who have experienced scams. They emphasized that the two datasets measure different aspects and use different parameters.

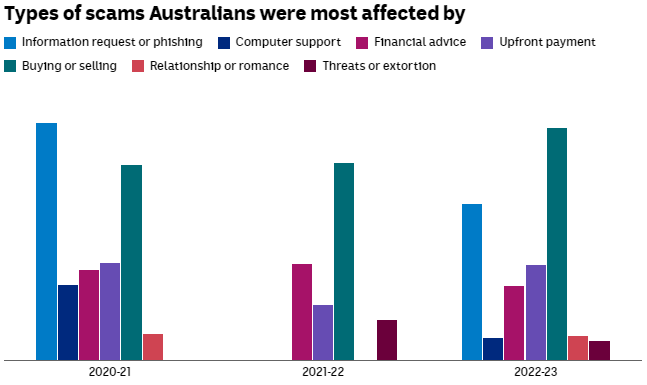

Both the ABS and Scamwatch data indicate that ‘buying and selling’ scams and ‘information request or phishing’ scams are among the most commonly experienced scam types in Australia.

These findings underscore the critical need for enhanced security measures, increased public awareness, and targeted protective strategies to combat the growing threat of card fraud and other scams.

Fewer Australians falling for phishing scams

The Australian Bureau of Statistics (ABS) has reported a slight decrease in the rate of Australians falling victim to scams, from 2.7 per cent in 2020-21 to 2.5 per cent in 2022-23. The report highlights that individuals aged between 35-44 are the most frequently affected by scams.

According to the ABS, a scam is defined as a “fraudulent invitation, request, notification or offer” aimed at obtaining personal details or money, or otherwise achieving a financial benefit through deceptive means. The report elaborates that experiencing a scam involves responding to it by seeking further information, providing money or personal information, or accessing links associated with the scam.

In 2022-23, the most common type of scam experienced by Australians was a buying or selling scam, affecting 1.0 per cent of the population (approximately 199,200 people). This was followed by information request or phishing scams, which affected 0.6 per cent of the population (around 134,700 people).

These findings underscore the importance of continued vigilance and public education to protect against the evolving threat of scams and fraudulent activities.

Source: Australian Bureau of Statistics

The Australian Bureau of Statistics (ABS) has reported a significant rise in the number of people being notified about scam incidents by their bank or financial institution. The notification rate increased to 49 per cent, up from 32 per cent in the previous year.

William Milne, head of crime and justice statistics at the ABS, emphasized the focus on individuals who responded to scams. “We’re only interested in those who responded to scams this time,” Milne said. “That’s [people] that have actually gone in and clicked the link into the follow-up process.”

Milne expressed optimism about the growing awareness among the public. “People are becoming more and more aware of it and, I’m hoping, getting more clever at recognising it before they get too invested,” he added.

These findings highlight the importance of continued vigilance and education to help individuals recognize and avoid falling victim to scams.

The Australian Bureau of Statistics (ABS) has reported a slight increase in the rates of identity theft, rising from 0.8 per cent in 2021-22 to 1.0 per cent in 2022-23.

According to the report, identity theft involves the use of someone’s personal details in stolen, fraudulent, or forged documents without permission, or otherwise illegally appropriating another’s identity.

The report also highlights the issue of online impersonation, which occurs when someone’s personal details are purposefully misused to impersonate them online or by phone, without their permission.

These findings underscore the importance of safeguarding personal information and being vigilant against identity theft and online impersonation. Enhanced security measures and public awareness are crucial in combating these forms of fraud.

Source: Australian Bureau of Statistics

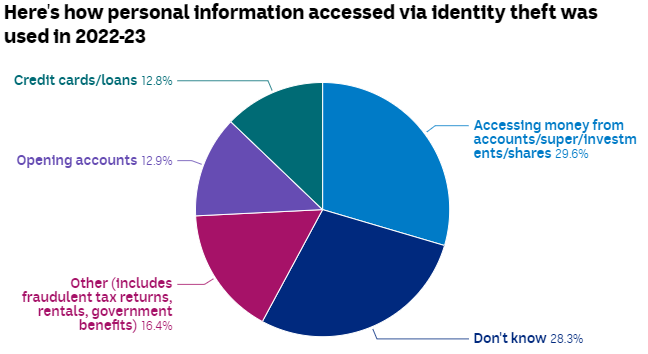

In most cases of identity theft, the stolen information is used to obtain money, according to the Australian Bureau of Statistics (ABS). William Milne, head of crime and justice statistics at the ABS, stated, “We found that about 200,000 people had had their identity stolen, and in about a third [of cases] they’ve actually used these documents to obtain money from a bank, super fund, or from shares or dividends.”

Milne emphasized the serious implications of identity theft, noting, “You sort of think, ‘it’s ID theft, what can they do?’ They can actually create your identification and scam your money.”

The Australian Competition and Consumer Commission (ACCC) has advised individuals who believe they have been scammed to take immediate action. The recommended steps are to contact their bank or financial institution first, then inform the platform on which they were scammed about the incident.

These findings and recommendations highlight the critical need for vigilance and prompt action to mitigate the impact of identity theft and protect personal financial assets.